Effective Savings Strategies

Establishing effective saving strategies is a cornerstone of personal finance management. A well-structured approach begins with creating a comprehensive budget that outlines income, essential expenses, and discretionary spending. Tracking expenses meticulously can shed light on where your money goes and helps identify areas for potential savings. By setting realistic savings goals, individuals not only motivate themselves but also provide a clear path to financial stability.

Automating savings through direct deposits is a powerful tactic to ensure consistency. Allocating a portion of your paycheck directly to a savings account minimizes the temptation to spend. Furthermore, exploring high-yield savings accounts can amplify the benefits of saving. These accounts often offer higher interest rates compared to traditional savings accounts, leading to more significant growth over time.

An often-overlooked yet vital component of a robust saving plan is the establishment of an emergency fund. This fund acts as a financial buffer against unexpected expenses such as medical emergencies, car repairs, or job loss. To determine an appropriate emergency fund amount, consider aiming for three to six months’ worth of living expenses. This ensures that you can maintain your usual standard of living during unforeseen circumstances.

Growing an emergency fund can be achieved through consistent, small contributions. For instance, diverting a portion of any bonus or tax refund directly into this fund can accelerate its growth. Moreover, individuals should periodically review and adjust their savings strategies to stay in line with their financial goals and life changes.

Real-world examples can serve as effective motivators. Consider Jane, who managed to save $5,000 within a year by automating her savings and cutting non-essential expenditures. Conversely, common pitfalls like sporadic saving or underestimating expenses can derail financial goals. Avoiding these mistakes by maintaining discipline and continually monitoring financial health can significantly enhance one’s ability to save effectively.

By implementing these practical strategies, individuals can not only meet their immediate financial goals but also build a solid foundation for future wealth and security.

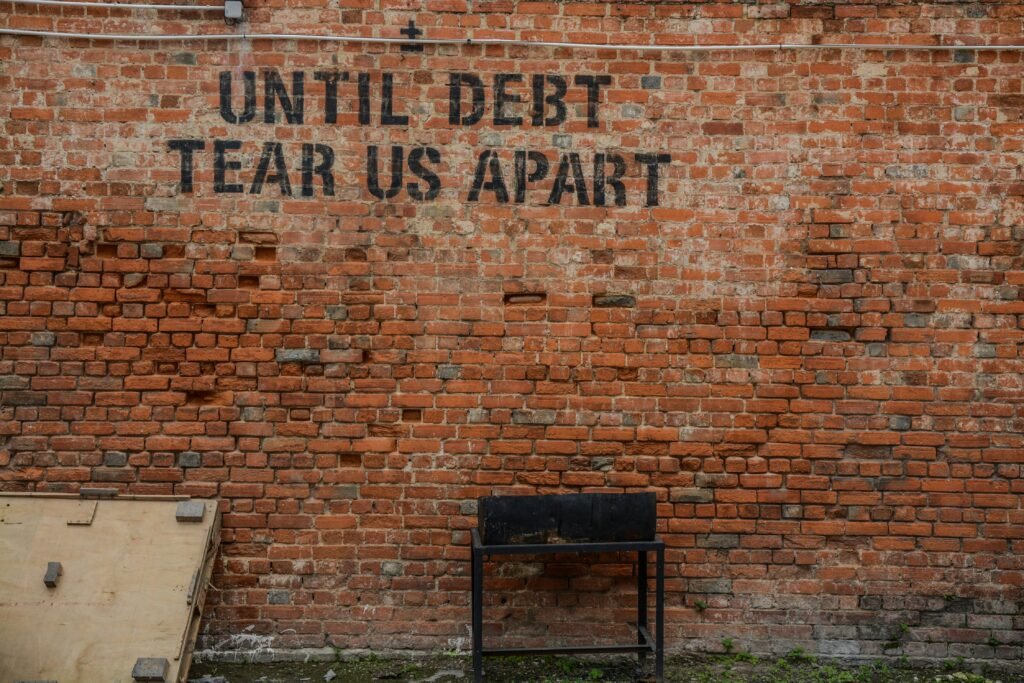

Debt Relief and Wealth Building Techniques

Managing debt is a crucial step towards gaining control over one’s personal finances and paving the way for wealth accumulation. Effective methods such as the debt snowball and avalanche strategies can be instrumental. With the debt snowball method, individuals focus on paying off the smallest debt first while making minimum payments on larger ones, gradually building momentum. Conversely, the avalanche method prioritizes debts with the highest interest rates, which can lead to significant interest savings over time.

Debt consolidation is another viable option. By combining multiple debts into a single payment, often at a lower interest rate, individuals can streamline their repayment process and potentially reduce overall interest costs. Professional debt counseling services can also offer tailored solutions and guidance, helping to create a feasible debt repayment plan and enhancing credit scores through improved financial habits.

Credit scores play a significant role in personal finance management. Maintaining a good credit score is essential as it affects borrowing costs and access to credit. Individuals should regularly monitor their credit reports, correct any inaccuracies, and engage in financial behaviors that boost credit health, such as on-time payments and low credit utilization ratios.

Transitioning from debt relief to wealth building involves understanding foundational investment principles. Key investment vehicles include stocks, bonds, and real estate. Diversified investments across these classes can promote long-term growth. For beginners, stocks represent ownership in companies, offering the potential for capital appreciation, while bonds are debt securities providing fixed income with lower risk. Real estate investments can generate both rental income and value appreciation over time.

Retirement planning is another cornerstone of wealth building. Utilizing tax-advantaged accounts such as 401(k)s and IRAs can significantly impact long-term financial health. These accounts offer tax benefits that enhance savings growth. Additionally, maintaining a balanced portfolio tailored to one’s risk tolerance and investment horizon is crucial, with considerations for both low-risk investments and higher yield opportunities.

Avoiding common investment pitfalls, such as reacting impulsively to market fluctuations, is imperative. Consistent, informed, and strategic investment habits contribute significantly towards achieving financial stability and long-term wealth.