Introduction to Credit Card Debt Consolidation

Credit card debt consolidation is a financial strategy aimed at simplifying and potentially reducing the burden of multiple credit card debts. At its core, debt consolidation involves merging various credit card balances into a singular loan or payment structure. This consolidation can streamline monthly payments, making debt management more straightforward for individuals. By consolidating multiple debts, it may also be possible to secure a lower overall interest rate, ultimately reducing the total amount paid over time.

There are several methods of debt consolidation, each catering to different financial situations and objectives. One of the most common methods is using a balance transfer credit card. This approach entails transferring existing credit card balances to a new card, often with an introductory period of low or zero interest, providing a window to pay off the debt more efficiently.

Another method is acquiring a personal loan, which can then be used to pay off credit card balances. Personal loans typically offer fixed interest rates and set repayment terms, facilitating easier budgeting and a clearer timeline for becoming debt-free.

Additionally, some individuals choose to consolidate their debt through home equity loans or lines of credit. This option leverages the equity built up in one’s property to secure a loan at potentially lower interest rates than those offered by credit cards. However, it is essential to consider the risk involved, as the home serves as collateral.

By exploring these various methods of credit card debt consolidation, individuals can identify the most suitable approach to address their financial circumstances. This foundational understanding sets the stage for a deeper examination of the pros and cons associated with credit card debt consolidation, helping readers make informed decisions about managing their debt more effectively.

Advantages of Credit Card Debt Consolidation

Credit card debt consolidation can offer numerous benefits, making it an attractive option for individuals struggling with multiple credit card balances. One of the primary advantages is securing a lower interest rate. By consolidating higher-interest credit card debts into a single loan with a reduced interest rate, borrowers can potentially save a significant amount of money over time. This reduction in interest can lower the total repayment amount, easing the financial burden on the individual.

Another notable benefit is the potential improvement in one’s credit score. When multiple credit card debts are consolidated into a single loan, it often results in more streamlined and timely payments. Regular, on-time payments are a critical factor in maintaining and enhancing credit scores. Moreover, consolidation can positively affect the credit utilization ratio, which is the amount of credit used relative to the total available credit. A lower utilization ratio can further boost one’s credit score, presenting long-term financial advantages.

Convenience is another significant factor that makes credit card debt consolidation appealing. Instead of juggling several monthly payments to different creditors, consolidation simplifies the process into a single, manageable payment. This consolidation can not only help in better financial planning and budgeting but also reduce the likelihood of missed or late payments, further safeguarding one’s credit rating.

In addition to the practical financial benefits, debt consolidation also provides psychological relief. Managing multiple debts can be a substantial source of stress and anxiety. Simplifying the debt repayment process through consolidation can alleviate this mental strain, leading to improved overall well-being. Individuals often feel a sense of control and clarity over their finances, which can be instrumental in achieving long-term financial health.

Disadvantages of Credit Card Debt Consolidation

While credit card debt consolidation can provide a structured pathway to manage debt, it is essential to consider the potential drawbacks before deciding on this financial strategy. One significant concern is the possibility of incurring additional fees. Balance transfers and loan origination processes often come with associated costs that can add up. For instance, balance transfer fees can be as high as 3%-5% of the transferred amount, and loan origination fees for personal loans might also be substantial, depending on the lender.

Another critical factor to consider is the impact of an increased loan term on overall interest payments. Even with a lower interest rate, extending the repayment period can result in paying more interest over time. This situation can negate some of the benefits of consolidation, as the seemingly reduced monthly payments could lead to higher total costs in the long run.

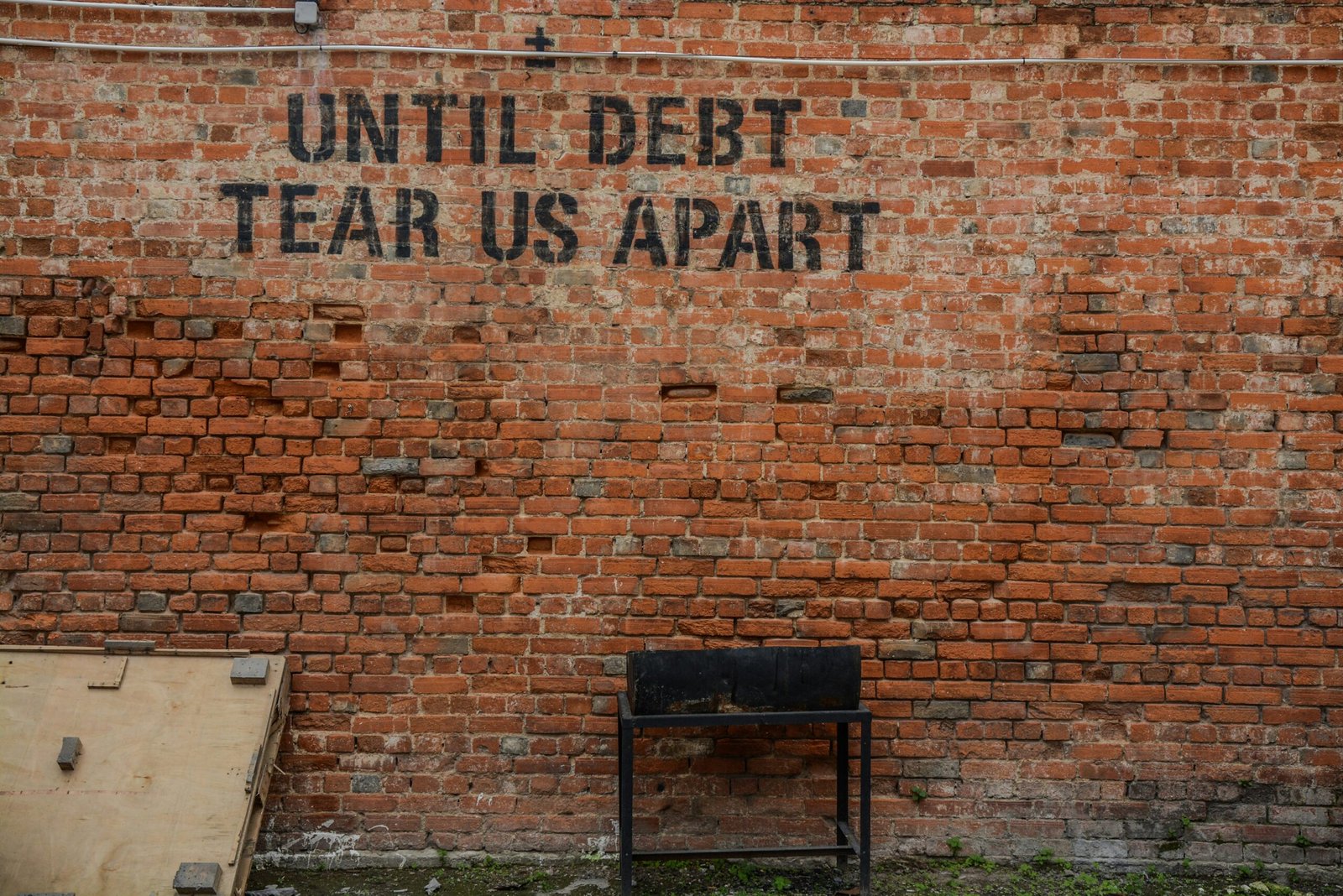

Additionally, one of the more profound risks of credit card debt consolidation is the potential to revert to old spending habits. Once the pressure of multiple debts is alleviated, individuals might be tempted to accumulate new debt, thinking the consolidation loan is a solution rather than a management tool. This behavior can culminate in a cycle of recurring debt, leading to financial instability.

The impact on credit scores is another aspect that warrants careful consideration. Opening new accounts for the purpose of consolidation might temporarily lower credit scores due to hard inquiries and the alteration in the average age of accounts. Conversely, closing old accounts that are paid off through consolidation can reduce the available credit, negatively affecting the credit utilization ratio. Both actions could lead to a less favorable credit score in the short-term, impacting future borrowing opportunities.

To make an informed decision about credit card debt consolidation, it is imperative to weigh these potential downsides against the benefits. Understanding the inherent risks and planning accordingly can help in achieving long-term financial stability without falling into the pitfalls of new or ongoing debt.

Is Credit Card Debt Consolidation Right for You?

Deciding whether credit card debt consolidation is the appropriate financial strategy for your specific situation requires a thorough examination of several important factors. Determining the total amount of debt you owe is fundamental. Start by calculating the cumulative balance of your credit card debts to understand the magnitude of your financial obligation.

Another crucial aspect to consider is the interest rates on your existing credit card debts. Compare these rates with those offered by consolidation loans or balance transfer options. If the consolidation option presents a lower average interest rate, it might result in significant long-term savings, thereby making it an attractive option.

Your personal discipline in managing spending and repayment is also vital. Debt consolidation provides the potential for simpler, single monthly payments, but this could lead some individuals to mistakenly believe they have newfound financial room to accrue more debt. Hence, it is imperative to commit to not accumulating additional debt post-consolidation.

Exploring various consolidation options is advised. Some common choices include personal loans, balance transfer credit cards, and home equity loans. Each option has its own set of benefits and potential drawbacks. For instance, balance transfer cards often come with an introductory zero-percent interest rate for a set period, but may also include balance transfer fees. Personal loans might offer fixed interest rates but could extend the repayment period.

Consulting with a financial advisor or credit counselor can provide you personalized guidance tailored to your unique financial scenario. They can assist in dissecting the nuances of each option, helping you choose the most suitable path for consolidation, as well as forming a comprehensive repayment plan.

Finally, it is essential to scrutinize your budget and financial goals. Assessing your income, expenses, and long-term financial objectives will aid in determining if consolidation aligns with your overall financial strategy. Engaging in this thorough self-assessment process ensures that the decision to consolidate is made with a full understanding of its implications on your financial health.