“`html

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness, serving as a crucial metric for lenders and financial institutions. This figure helps lenders decide whether to offer credit and under what terms. The most common types of credit scores are FICO and VantageScore, both of which typically range from 300 to 850. Within these ranges, a higher score signifies better creditworthiness, translating into more favorable borrowing conditions.

Credit scores play a pivotal role in various aspects of financial life. For instance, when applying for a loan or a mortgage, a higher credit score can result in lower interest rates, saving the borrower considerable money over the loan term. Conversely, a lower credit score might lead to higher interest rates or even loan denial.

Furthermore, the influence of credit scores extends beyond just borrowing. Many landlords check credit scores when evaluating potential tenants. A poor credit score might hinder an individual’s ability to secure housing. Additionally, some employers, especially those in the financial sector, may review credit scores as part of their hiring process. Though controversial, the rationale is that a low credit score may indicate financial irresponsibility, potentially affecting job prospects.

A good credit score is invaluable as it essentially acts as a financial passport, granting access to a variety of opportunities that can significantly impact one’s quality of life. Thus, understanding what a credit score is and how it’s used underscores its importance in contemporary financial management.

How is a Credit Score Calculated?

A credit score is a numerical representation of an individual’s creditworthiness, determined by a range of factors reported to credit bureaus. These factors are meticulously analyzed and weighted to provide a score that lenders use to evaluate the risk of lending money. Here, we explore the primary components that influence your credit score.

Payment History

The most significant factor in a credit score calculation is your payment history, which typically makes up about 35% of the score. This aspect examines whether you have made your credit payments on time. Consistency in on-time payments positively affects your score, while late or missed payments can significantly lower it. For example, a single 30-day late payment could reduce a score by as much as 100 points, depending on the overall credit profile.

Amounts Owed

The second major factor is the amounts owed, constituting around 30% of your credit score. This metric evaluates your credit utilization ratio, which is the percentage of total available credit you are currently using. Lower utilization ratios are typically favorable. For instance, if you have a credit limit of $10,000 and an outstanding balance of $2,500, your credit utilization ratio is 25%, which is considered good. However, a ratio above 30% might lower your score.

Length of Credit History

The length of your credit history accounts for approximately 15% of your credit score. This factor assesses the age of your oldest credit account, the age of your newest account, and the average age of all your accounts. A longer credit history generally improves your score, as it provides a more comprehensive picture of your financial habits.

New Credit

New credit inquiries and the number of recently opened accounts make up around 10% of your score. Numerous recent credit inquiries can indicate higher risk to lenders, potentially reducing your score. For example, applying for multiple credit cards in a short period can signify financial instability.

Types of Credit Used

The diversity of your credit accounts, or the types of credit used, also influences your score, albeit contributing only 10%. This includes a mix of credit cards, mortgage loans, installment loans, etc. Demonstrating responsible management across various types of credit can positively impact your score.

Credit bureaus, like Equifax, TransUnion, and Experian, collect and report information from creditors to compile and publish credit scores. By understanding these key components and how they are weighted, individuals can better manage their credit to maintain or improve their credit scores.

Strategies to Improve Your Credit Score

Improving your credit score can significantly enhance your financial stability and access to credit facilities. A great resource for education is Credit Score Secrets by Robert Newton that can help you implement these strategies. A pivotal strategy to elevate your credit score is ensuring timely bill payments. Promptly paying off your bills demonstrates reliability to lenders. To facilitate this, setting up payment reminders or automatic payments can be highly effective, helping you avoid missed or late payments, which can negatively impact your credit score.

Reducing outstanding debt is another critical step. Focus on paying down high-interest debts first, and consider the snowball method to tackle smaller debts incrementally. Limiting new credit inquiries is also advisable since frequent credit applications can lower your score. Use credit responsibly by ensuring that you do not exhaust your credit limits; this involves understanding and managing your credit utilization ratio.

Credit utilization should ideally be kept below 30%. For instance, if you have a total credit limit of $10,000, aim to keep your balance under $3,000. A lower utilization ratio signals to lenders that you are a responsible borrower. Additionally, maintaining older accounts can positively impact your credit history length, which is crucial for a good credit score. Closing old accounts can reduce the average age of your credit history and potentially lower your score.

Regularly reviewing your credit reports is essential. Credit reports can contain errors that may adversely affect your score. By checking your reports periodically, you can spot inaccuracies and dispute them promptly. Correcting errors can lead to a quick improvement in your score. Several individuals have seen noticeable score improvements by addressing inaccuracies directly with credit bureaus.

For example, Jane Doe implemented these strategies and witnessed a remarkable credit score boost from 620 to 750 within a year. Her disciplined approach to payments, managing her credit utilization, and addressing report errors paved the way for her financial upliftment.

By following these actionable steps, you can systematically improve your credit score and secure better financial opportunities.

Monitoring and Maintaining a Healthy Credit Score

Achieving a good credit score is a significant milestone, but maintaining it requires continuous monitoring and proactive management. Regularly checking your credit score can help you identify any discrepancies or signs of potential fraud early. AnnualCreditReport.com offers consumers a free annual credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion. This free service serves as a practical starting point for understanding and keeping track of your credit standing.

In addition to free annual credit reports, subscription-based credit monitoring services can provide more frequent updates. These services often include features such as real-time alerts for any changes in your credit profile, helping you stay aware and take prompt action if something appears suspicious.

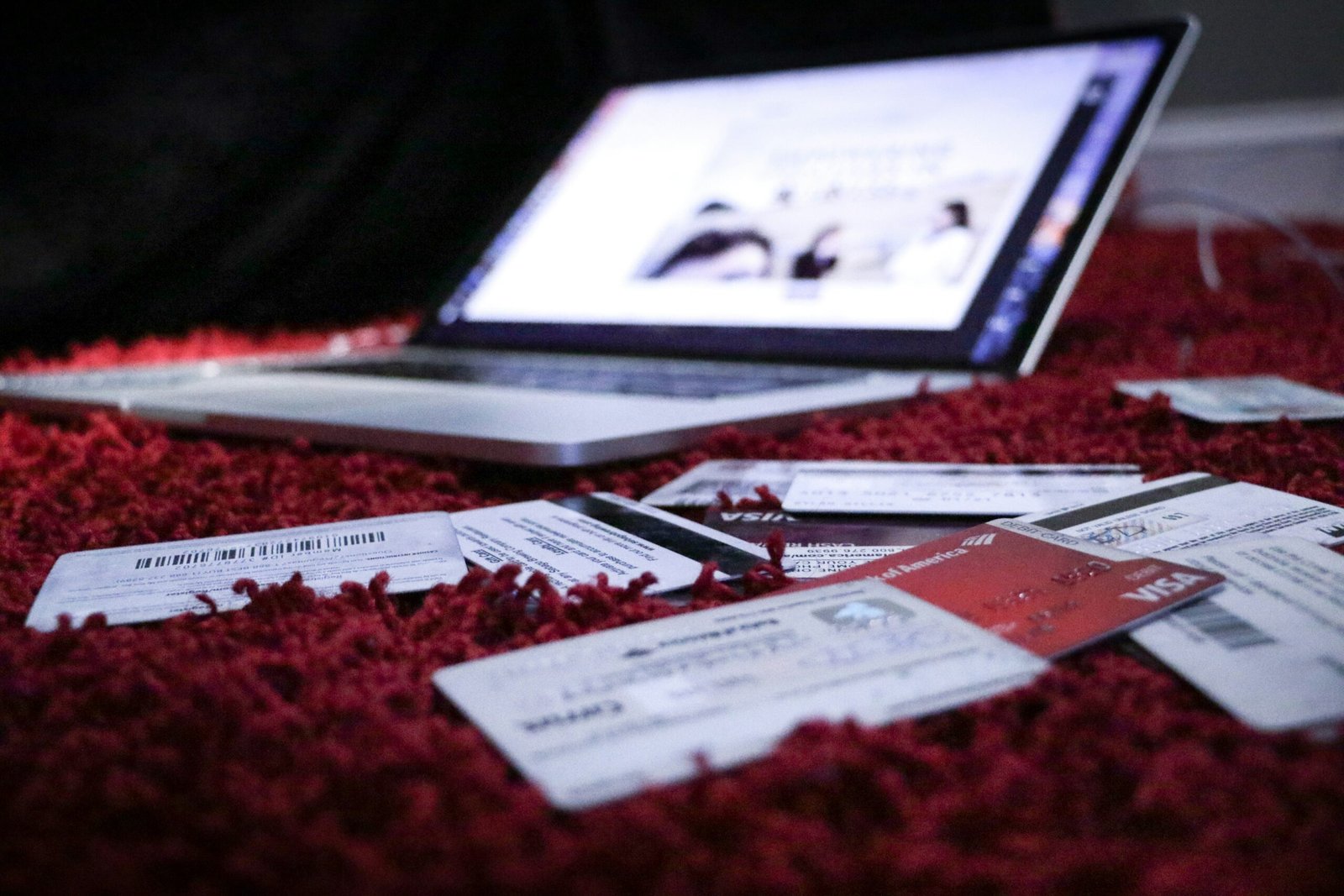

Safeguarding your personal information is crucial to maintaining a healthy credit score. Identity theft and fraud can have severe detrimental effects on your credit. Employing best practices, such as using strong, unique passwords for online accounts and being cautious about sharing personal information, can significantly reduce the risk of becoming a victim of cybercrimes.

Another critical element in maintaining a healthy credit score is the long-term benefits it provides. A stable and high credit score can lead to better financial stability, including lower interest rates on loans and mortgages, as well as cost savings on insurance premiums. These financial advantages can contribute to broader life goals, such as purchasing a home or securing a favorable car loan.

Setting financial goals and periodically reviewing them is a strategic approach to sustaining a good credit score. By regularly assessing your financial situation and adjusting your goals as needed, you can address any factors that might negatively impact your credit score proactively. Monitoring spending habits, keeping credit card balances low, and paying bills on time are concrete steps in maintaining a healthy financial profile.